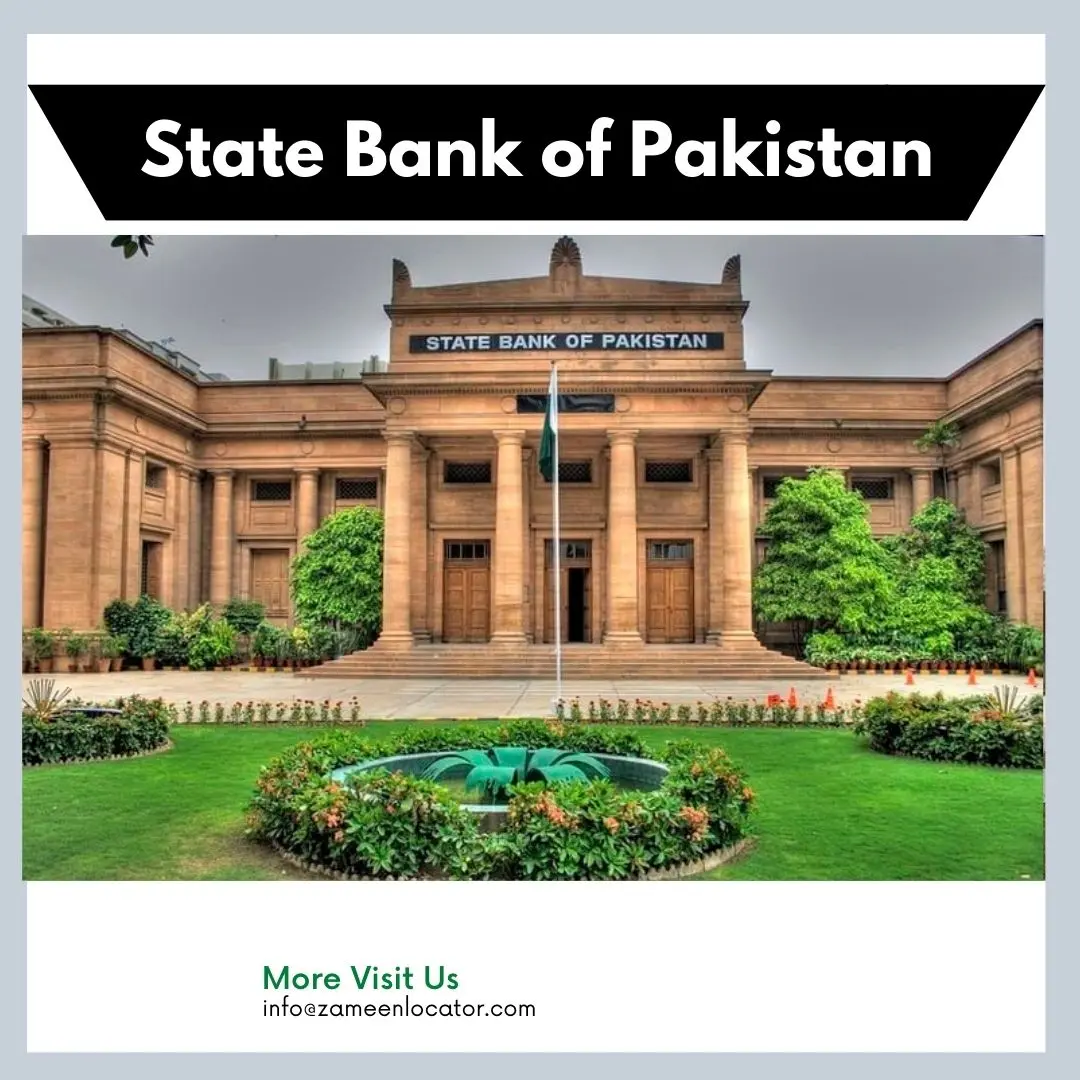

The State Bank of Pakistan: Reserves, Rules, Policies And Rich History

- The State Bank of Pakistan (SBP) serves as the central bank of Pakistan, playing a crucial role in the country's financial and economic stability. Established in 1948, SBP has a rich history marked by significant milestones, evolving policies, and stringent regulatory frameworks. This blog explores the reserves, rules, policies, and historical journey of the State Bank of Pakistan, highlighting its critical contributions to the nation's economy.

Rich History

- The State Bank of Pakistan was inaugurated on July 1, 1948, by Muhammad Ali Jinnah, the founding father of Pakistan. SBP was a pivotal moment in the newly independent country’s history, ensuring monetary and financial stability. Over the decades, SBP has undergone numerous transformations to adapt to the changing economic landscape.

Key Historical Milestones

- 1948: Establishment of SBP, taking over the monetary functions from the Reserve Bank of India.

- 1956: Introduction of the State Bank of Pakistan Act, which expanded the bank's functions and granted it more autonomy.

- 1974: Pakistani banks, placing them under SBP's supervision to ensure better regulation and control.

- 1994: Initiation of financial sector reforms, including the privatization of nationalized banks and the introduction of a market-based exchange rate system.

- 2006: Establishment of the SBP Banking Services Corporation to manage the operational functions of SBP.

Reserves

- The foreign exchange reserves held by the State Bank of Pakistan are crucial for economic stability. These reserves support the national currency, manage the balance of payments, and ensure the country can meet its international financial obligations.

Components of Reserves

- Foreign Currency Assets:

Primarily in US dollars, these assets include deposits and bonds held in foreign banks.

- Gold Reserves:

Physical gold is held as a secure asset.

- Special Drawing Rights (SDRs):

International reserve assets allocated by the International Monetary Fund (IMF).

Importance of Reserves

- Currency Stability:

Helps maintain the value of the Pakistani Rupee.

- Economic Confidence:

Instills confidence among investors and international markets regarding Pakistan's economic stability.

- Crisis Management:

Provides a buffer during economic downturns or financial crises.

Rules and Regulations

- The State Bank of Pakistan is responsible for formulating and implementing monetary policy, regulating the banking sector, and ensuring financial stability. The regulatory framework is designed for a robust and resilient financial system.

Key Regulatory Functions

- Monetary Policy:

SBP uses tools like interest rates and open market operations to control inflation and stabilize the currency.

- Banking Supervision:

Ensures banks operate within the legal framework and maintain financial health.

- Foreign Exchange Regulation:

Manages the country's foreign exchange reserves and oversees foreign exchange transactions.

- Financial Inclusion:

Promotes access to financial services for all particularly the underserved and unbanked.

Regulatory Initiatives

- Anti-Money Laundering (AML) and Combating the Financing of Terrorism (CFT):

Implementing stringent measures to prevent financial crimes.

- Credit Information Bureau (CIB):

Maintaining a database of credit information to help banks assess the creditworthiness of borrowers.

- Prudential Regulations:

Setting standards for capital adequacy, asset quality, management, earnings, and liquidity for banks.

Policies

- SBP's policies are designed to achieve macroeconomic stability, promote sustainable economic growth, and foster a stable financial system. These policies are periodically reviewed and updated to respond to evolving economic challenges.

Monetary Policy

- The primary goal of SBP’s monetary policy is to achieve price stability and support economic growth. The Monetary Policy Committee (MPC) meets regularly to set the policy interest rate based on indicators such as inflation, growth, and exchange rates.

Exchange Rate Policy

- SBP manages the exchange rate through a market-based system, allowing the Pakistani Rupee's value to be determined by supply and demand conditions in the foreign exchange market. However, SBP intervenes when necessary to prevent excessive volatility.

Development Finance

- SBP promotes economic development by providing financial services and support to key sectors such as agriculture, small and medium enterprises (SMEs), and housing. Initiatives include concessional financing schemes, credit guarantee schemes, and capacity-building programs.

Financial Inclusion

- SBP’s financial inclusion policy aims to provide access to financial services to all segments of society. Programs include branchless banking, microfinance, and digital financial services.

Consumer Protection

- To protect consumers' rights, SBP has established frameworks for fair treatment of customers, transparency in financial transactions, and dispute resolution mechanisms.

Conclusion

- The State Bank of Pakistan has played a pivotal role in shaping the financial and economic landscape of the country. From its inception in 1948 to its current role, SBP has continually evolved to meet the challenges of a dynamic global economy. Through effective management of reserves, stringent regulatory frameworks, and forward-looking policies, SBP ensures the stability and growth of Pakistan's financial system. As the central bank continues to adapt and innovate, its rich history and robust foundation will undoubtedly support Pakistan's economic aspirations for years to come.